Call Us 1-800-234-56-78

Call Us

See rates for yourself - Run a Quote

Have a Medigap Plan and your Price has Increased..

Let Golden Years Shop Your Rate$

We will keep you in the same lettered Plan and you can keep Your Doctors!

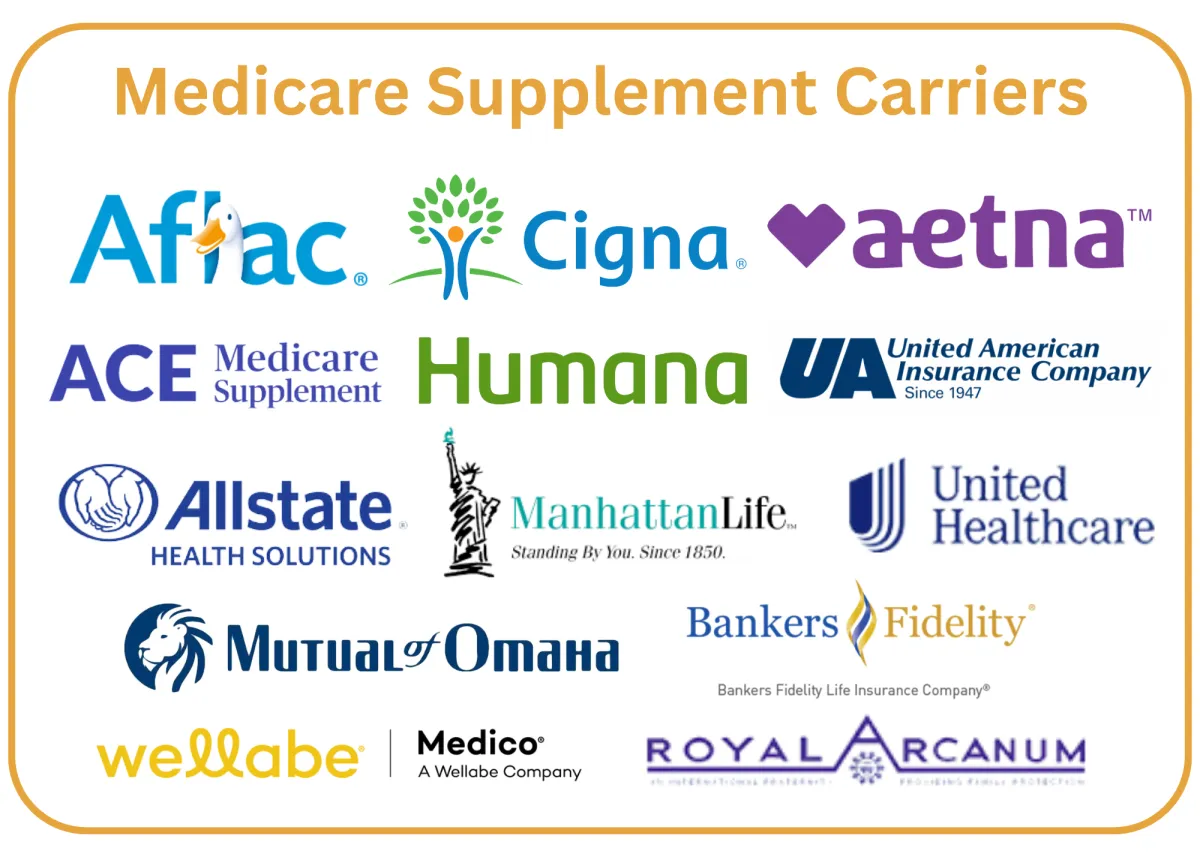

Some of MediGap carriers we represent

Click name of the carrier & review Medical Questions to see if you can qualify for a lower price --------->

Download Medicare's Guide to Medigap Policies

pg 33

If you’ve had your current Medigap policy longer than 6 months and want to replace it with a new one with the same benefits and the insurance company agrees to issue the new policy, they can’t write pre‑existing conditions, waiting periods, elimination periods, or probationary periods into the replacement policy.

pg 34

Switching Medigap policies (continued)

Why would I want to switch to a different Medigap policy?

1. You’re paying for benefits you don’t need.

2. You need more benefits than you needed before

3. Your current Medigap policy has the right benefits, but you want to change your insurance company.

4. Your current Medigap policy has the right benefits, but you want to find a policy that’s less expensive.

Review excerpts

pg 9

Cost is usually the only difference between Medigap policies with the same plan letter sold by different insurance companies.

pg 19

As discussed on the previous pages, the cost of Medigap policies can vary widely. There can be big differences in the premiums that different insurance companies charge for exactly the same coverage. As you shop for a Medigap policy, be sure to compare Medigap plan types with the same letter, and consider the type of pricing each insurance company uses. (See pages 17–18.) For example, compare Plan G from one company with Plan G from another company.

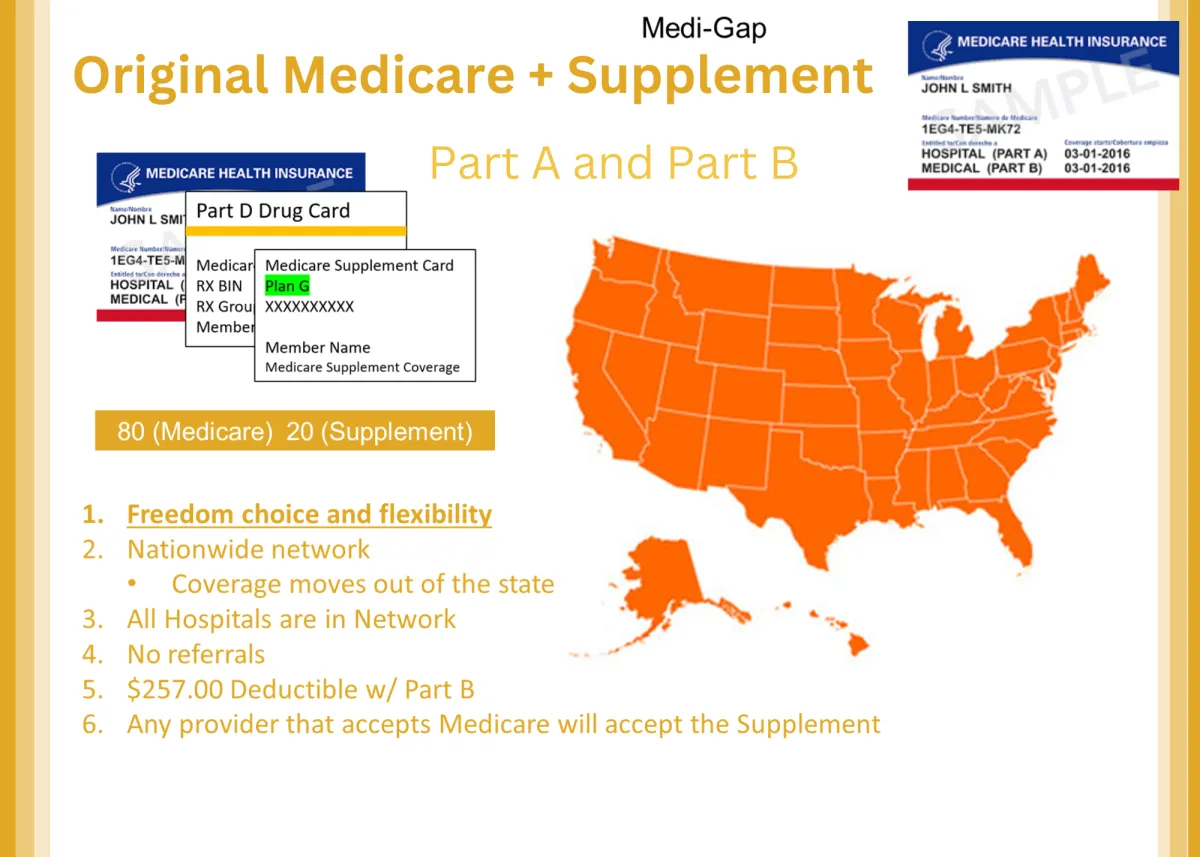

What’s a Medigap policy?

A Medigap policy is an insurance policy that helps fill "gaps" in Original Medicare and is sold by private companies.

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. Medigap policies are sold by private companies, and can help pay for some of the costs that Original Medicare doesn't, like copayments, coinsurance, and deductibles.

Medigap Plans

* Plans F and G also offer a high-deductible plan in some states (Plan F isn't available to people new to Medicare on or after January 1, 2020.) If you get the high-deductible option, you must pay for Medicarecovered costs (coinsurance, copayments, and deductibles) up to the deductible amount of $2,490 in 2022 before your policy pays anything, and you must also pay a separate deductible ($250 per year) for foreign travel emergency services.

**Plans K and L show how much they'll pay for approved services before you meet your out-of-pocketyearly limit and your Part B deductible ($233 in 2022). After you meet these amounts, the plan will pay 100% of your costs for approved services for the rest of the calendar year.

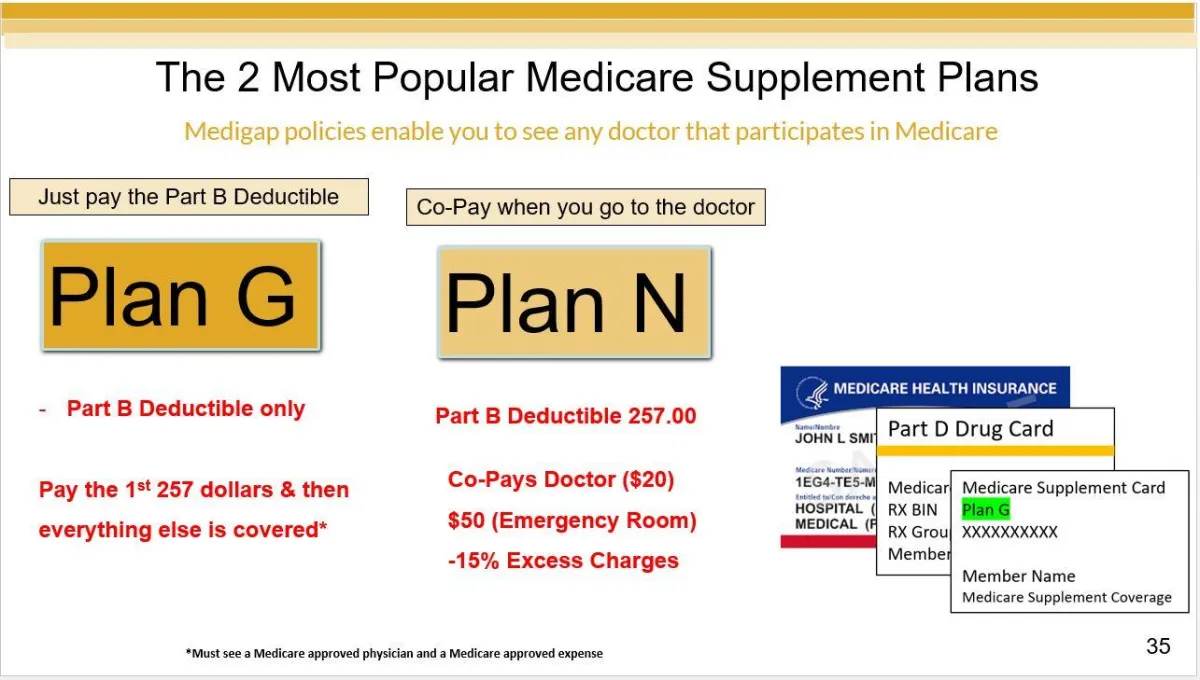

*** Plan N pays 100% of the Part B coinsurance, except for a copayment of up to $20 for some office visits and up to a $50 copayment for emergency room visits that don’t result in an inpatient admission.

Some important facts

Regarding Medigap Plans:

The Letter of the Plan determines the benefits not the insurance carrier

Medigap Plans are standardized by CMS/Medicare so the coversage is the same regardless of the insurance company

Medigap plans simply pay after Medicare pays the 80%

So if your doctor accepts Medicare then they will also accept your Medicare Supplement Plan

Medigap is a supplemental insurance policy sold by private companies that can be used along with Medicare Parts A and B to fill the gaps in your coverage

It can help you cover costs related to deductibles, copayments, coinsurance, and more.

Plan F no longer available to people new to Medicare on or after January 1, 2020.

Plan N pays 100% of Part B coinsurance, except for a copayment of up to $20 for some office visits and up to a $50 copayment for emergency room visits

Chart based on 2025 numbers

Medicare Part B Deductible in 2025 is $257

For the most part, Medigap plans are designed to cover out-of-pocket costs for services that are covered by Medicare, as opposed to care that Medicare doesn’t cover and that the enrollee has to pay entirely out-of-pocket.

There can be big differences in the premiums that different insurance companies charge for exactly the same coverage.

As you shop for a Medigap policy, be sure to compare Medigap plan types with the same letter.

For example, compare Plan G from one company with Plan G from another company because they have the same benefits. Price varies.

One of the questions we get each year from our Medicare Supplement Clients is…

What can I do about the rate increase on My Medigap Policy???

Our clients tell us they are very pleased with their Medigap Plan because:

1. Your plan provides access to your doctors and covers your costs after Medicare pays.

2. Medigap Policies are designed to cover the 20% after Medicare pays their share.

Many Seniors are unaware:

If you have a Medigap or a Medicare Supplement Plan designated by a letter, Like a Plan G or Plan F ………. then any insurance company that sells that same Plan G or Plan F policy

has to offer the same benefits and provide you access to any doctor that participates with Medicare.

So we tell our clients that the Letter of the Plan determines the benefits, NOT THE INSURANCE COMPANY.

And the only difference between Medigap plans with the same letter is the premium.

So there’s good news.......

Now you can do something about it.

Fill out the form below and check out our web page that provides more information on how Medigap Policies work

Give my team a call and we will help you

shop your Medigap plan and ensure that your price is still competitive.

As independent brokers we have access to over 20 different insurance carriers.

Youtube

Your Licensed Medicare Insurance Broker:

55 Schanck Road Suite A-14

Freehold, NJ 07728

732-526-7659

Not affiliated or endorsed by the US Government or the federal Medicare program. We are an independent insurance brokerage agency working with many private insurance companies that provide supplemental coverage to the Medicare program.

What We Offer

Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore .

Life Insurance

Lorem ipsum dolor sit

amet, consectetur adip

sicing elit, sed do eius.

Health Insurance

Lorem ipsum dolor sit

amet, consectetur adip

sicing elit, sed do eius.

Car Insurance

Lorem ipsum dolor sit

amet, consectetur adip

sicing elit, sed do eius.

Travel Insurance

Lorem ipsum dolor sit

amet, consectetur adip

sicing elit, sed do eius.

Request a Free

Consultation

Whatever your insurance coverage needs are, we're here to help life go right. Get a quote or talk to an agent.

Omnis iste natus error sit voluptatem acc usan tium doloremque laudantium, totam em aper iameaque ipsa quae abillo inventore. veritatis ium doloremque

Quick Links

Our Features & Facts

Mission Statement

Customer Recognition

Careers

In Your Community

Media Center

Services

Auto Insurance

Home Insurance

Life Insurance

Condo Insurance

Renters Insurance

Retirement Insurance

Company

Roadside Assistance

Car Connection

Contractor Connection

Amica Advisor

Claims Advisor

Refer a Friend

© 2020 All rights reserved.

Terms of use Privacy Policy

© 2020 All rights reserved.

Terms of use Privacy Policy